Your 1-stop Odoo ERP software solutions partner

We design ERP solutions for businesses looking to enhance productivity and grow revenue by streamlining their accounting, sales, marketing, people and operational activities. Talk to us today.

I am looking to...

Enhance my

supply chain

Get your warehouse inventory and logistics processes lean and agile to ensure you stay ahead of demand.

Boost sales

& marketing

Streamline all sales and marketing via CRM to increase visibility into customer needs.

Manage human

resources better

All HR information in one place. Manage your employees more efficiently.

Improve my accounting

processes

Gain better visibility of your bottom line while ensuring adherence to Australian tax compliancy.

Why work with us?

40+ years experience

Perfecting the tools and processes to help businesses like yours succeed.

>100 projects completed

Giving us the experience and know-how to deliver you effective ERP solutions.

100% Australian-owned

All your data is stored securely onshore and local support is always available.

Dedicated teams

Enabling us to understand your needs and tailor ERP solutions that fit your needs.

Odoo Partner since 2009

First ever Australian Partner recognised for offering quality service.

3-time Odoo APAC Partner of the Year

For our commitment to outstanding client support.

Odoo ERP software solutions designed for businesses of all sizes.

Reach out to us today to learn more.

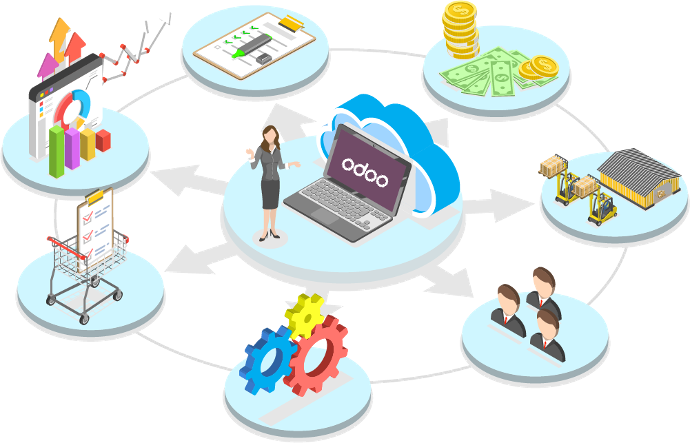

Streamline processes across your whole of business

Drive efficiency and transparency. Connect all your processes under one ERP platform, creating a unified view of the business.

Highly scalable ERP solutions tailored to your industry

Choose only what you need. Tailor solutions to integrate with your industry and the tools you are currently using to extend the capabilities of your existing processes.

Business intelligence at your fingertips

Centralise data from across your business. Get real-time insights into key business performance indicators for a single version of truth.

Expertise and trusted local support

As a certified Odoo partner with15 years of experience developing and implementing Odoo ERP solutions, rest assured you are in safe hands.

Our specialties...

Renewables distribution

Total business management system for business in the renewable energy industry.

Some of our clients

Ready to grow your business?

Making growth through technology easy.